Market Recap

November 29th, 2021

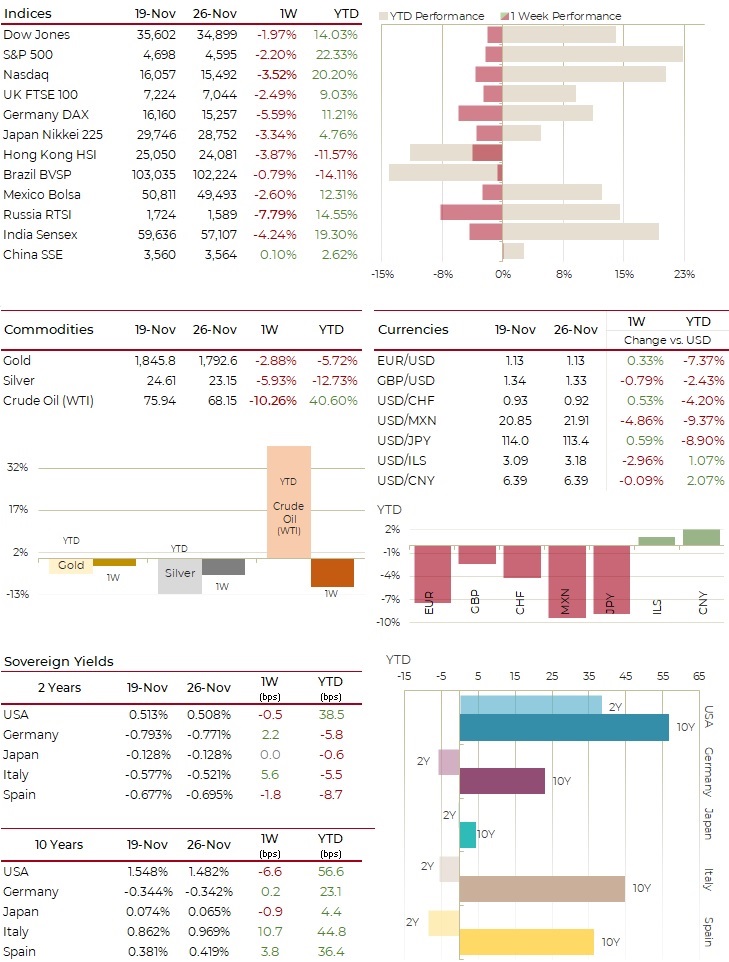

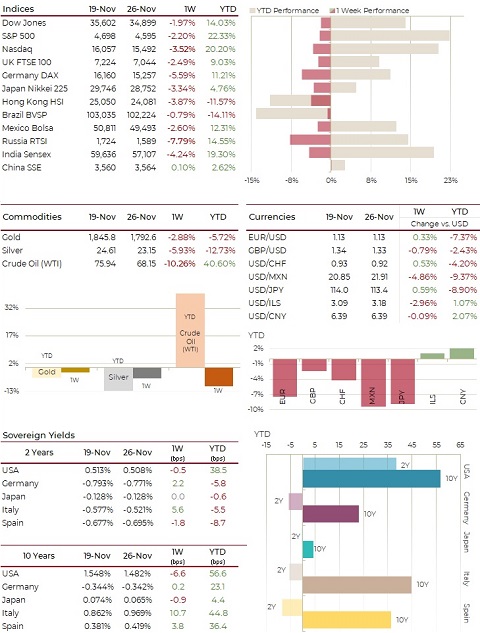

Markets

The appearance of the Omicron COVID Variant led US major indices (2.0-3.7%) and their European peers (2.5-6.1%) into a nosedive on the worst trading day of 2021. The VIX (59.8%) rallied to its highest level in nine months

Sectors

Value stocks held up better than growth, despite the pressure on leisure and travel-related stocks. Energy (1.7%) fared best as the early week rally more than offset Friday’s plunge. Consumer discretionary (3.6%) and IT (3.2%) fared worst

Rates

US treasury bond prices reversed course by surging sharply in response to Friday’s flight to safety. The renewed closure fears put in doubt the previous outlooks on interest rate increases and bond purchases taper, leading several banks to rethink their growth outlooks. The MOVE (21.9%) index soared

Commodities & FX

Oil (10.3%) prices sank sub-$70 on Friday, the lowest in more than two months, propelled by fears of demand slowdown. Gold (2.9%) and silver (5.9%) slid, while the USD (0.0%) remained flat vs. major currencies basket

Last Week's Headlines

Our Favorite Charts

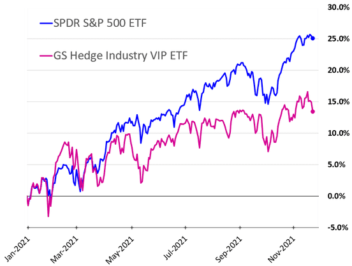

Hedge Funds Lagging

Source: Goldman Sachs, The Daily Shot

Investor Market Share in Home Purchases Hits Record

Source: Redfin

Market Performance

Disclaimer

This document is intended for informational purposes only and does not constitute an offer, recommendation, advice or invitation to enter into any transaction or investment, including but not limited to the purchase and/or sale and/or holding of securities and/or financial assets described herein. Analysis presented herein is based on information provided by external sources believed to be reliable, and assumptions which may change or not materialize. Levy Heritage did not independently verify the information and does not attest to its accuracy. Levy Heritage assumes no responsibility for errors or omissions in this document. Past performance is no guarantee of future results. Each investor has different goals and therefore should seek further personalized professional advice in relation to any investment which will take into account the investor’s specific data, circumstances and needs. Each investment involves risks and cannot be given a guarantee that the investment objectives or return on investment will be achieved, in full or in part. Levy Heritage does not provide legal or tax advice, and recommends that all people considering such advice consult with independent legal, tax and other relevant professional advisors in their countries of origin or residence. The information contained in this document is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed. Levy Heritage and/or its affiliated companies and/or its shareholders and/or employees shall not bear any responsibility for any damage and/or loss caused by the use of the enclosed information.