Market Recap

December 6th, 2021

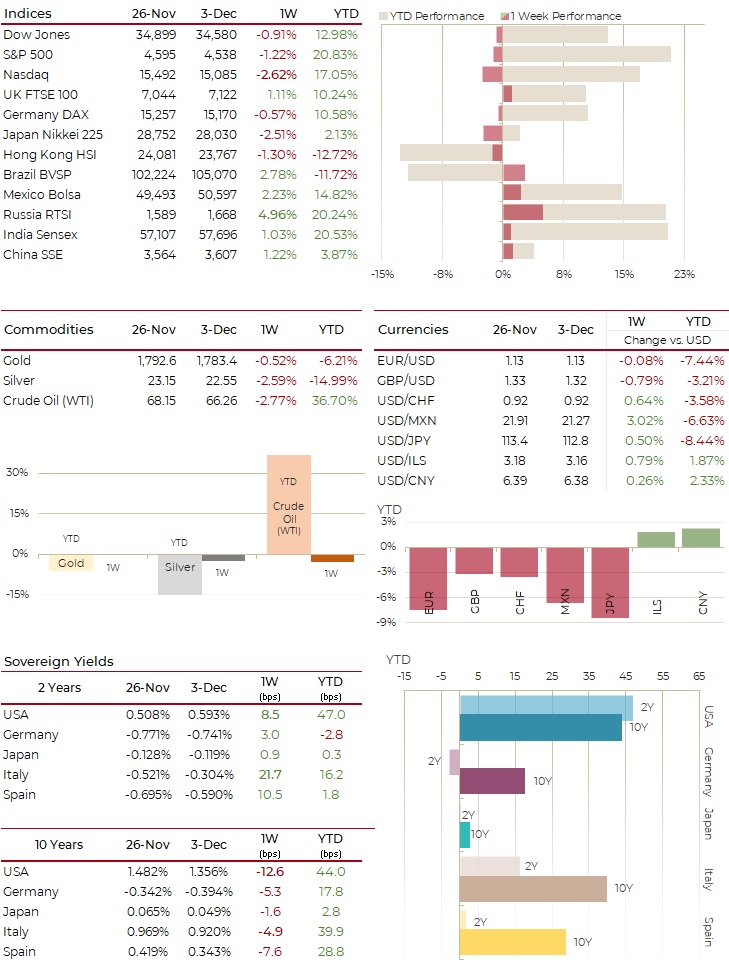

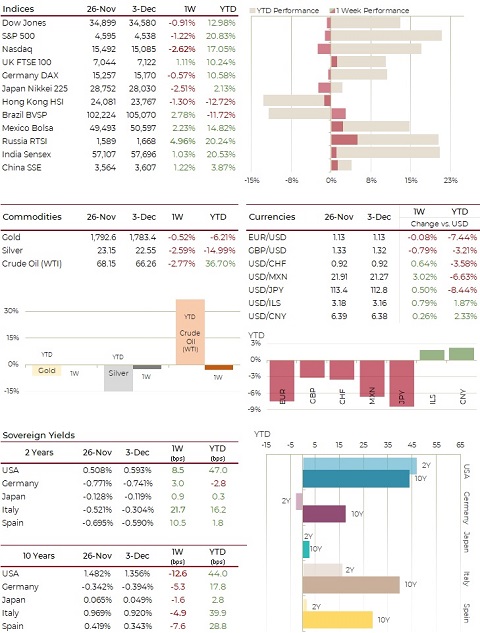

Markets

Fears of inflation and the Omicron variant continued to spur volatility for a second week. US major indices (0.9-3.7%) extended their decline, with the Nasdaq (2.6%) faring worst among the large-cap indices. The VIX (7.2%) surged and briefly touched 35, its highest level since January 2021

Sectors

Cyclicals and small-caps underperformed defensives and large-caps. Utilities (1.0%) led among the US sectors, followed by a modest gain for real estate (0.1%). Communication services (2.7%) and consumer discretionary (2.4%) tumbled

Rates

US and European yield curves flattened reflecting concerns over further Covid shutdowns and a possible acceleration of monetary tightening by the Fed. The US 10-year treasury yield (12.6 bps) dropped sharply back to 1.36% from 1.69% two weeks ago. US Short-term yields rose on concerns of persistent inflation following Chairman Powell’s testimony. The MOVE (11.5%) index fell

Commodities & FX

Oil (2.8%) prices continued to sink, posting more than a 20% decline from recent highs (October), as the Omicron variant rattled the markets. Gold (2.9%) and silver (5.9%) continued to decline, and the USD (0.1%) remained generally muted vs. major currencies basket

Last Week's Headlines

Our Favorite Charts

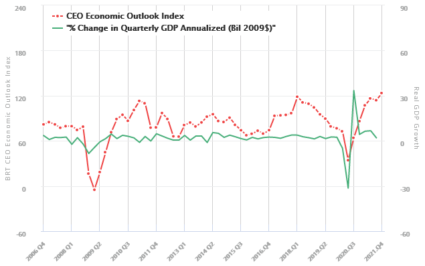

US CEO Economic Outlook at Record-High

Source: Business Roundtable

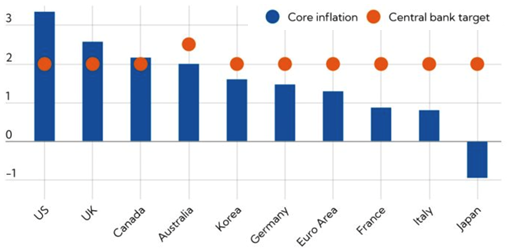

Core CPI vs Inflation Target

Source: Haver Analytics, IMF

Market Performance

Disclaimer

This document is intended for informational purposes only and does not constitute an offer, recommendation, advice or invitation to enter into any transaction or investment, including but not limited to the purchase and/or sale and/or holding of securities and/or financial assets described herein. Analysis presented herein is based on information provided by external sources believed to be reliable, and assumptions which may change or not materialize. Levy Heritage did not independently verify the information and does not attest to its accuracy. Levy Heritage assumes no responsibility for errors or omissions in this document. Past performance is no guarantee of future results. Each investor has different goals and therefore should seek further personalized professional advice in relation to any investment which will take into account the investor’s specific data, circumstances and needs. Each investment involves risks and cannot be given a guarantee that the investment objectives or return on investment will be achieved, in full or in part. Levy Heritage does not provide legal or tax advice, and recommends that all people considering such advice consult with independent legal, tax and other relevant professional advisors in their countries of origin or residence. The information contained in this document is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed. Levy Heritage and/or its affiliated companies and/or its shareholders and/or employees shall not bear any responsibility for any damage and/or loss caused by the use of the enclosed information.